¨ Preliminary Proxy Statement | ||

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Pursuant to Rule 14a-12 | ||

SPRINT NEXTEL CORPORATION

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transactions applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing party: |

| (4) | Date filed: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

MAY 13, 200812, 2009

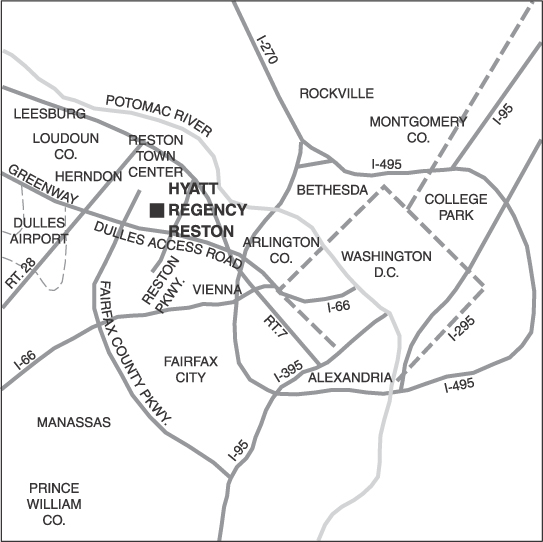

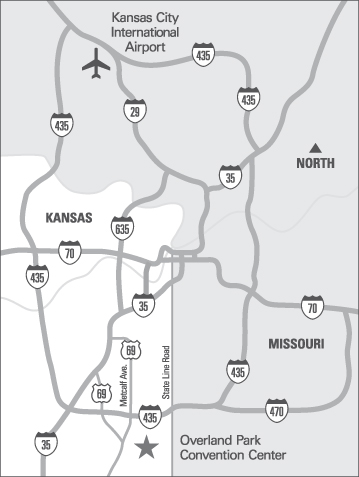

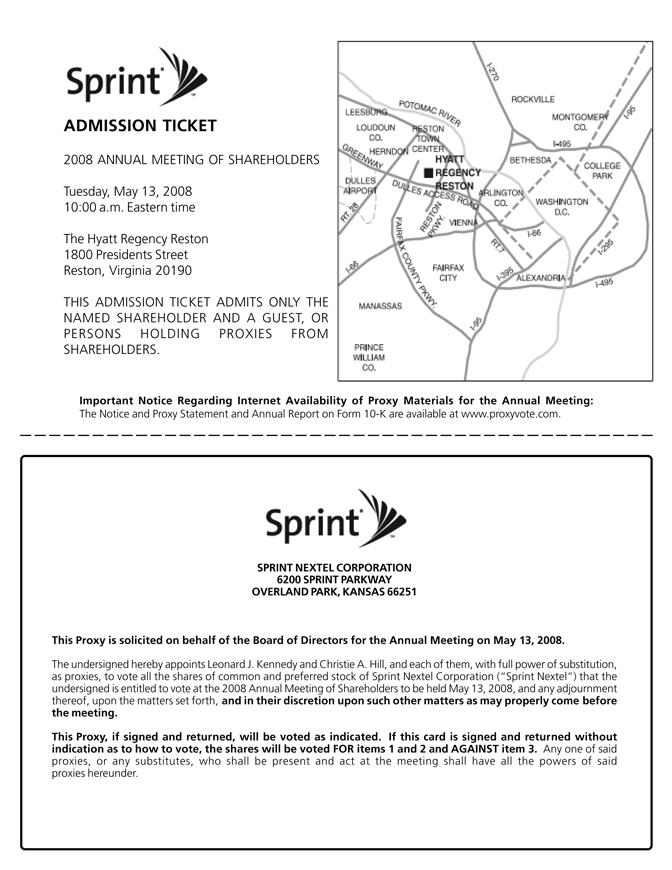

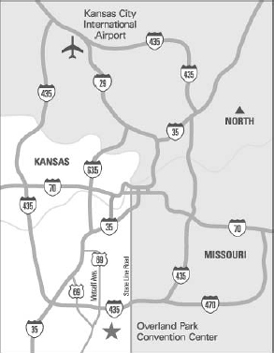

We will hold the annual meeting of shareholders of Sprint Nextel Corporation on Tuesday, May 13, 200812, 2009 at 10:00 a.m. EasternCentral time at The Hyatt Regency Reston, 1800 Presidents Street, Reston, Virginia 20190 (703-709-1234)Overland Park Convention Center, 6000 College Boulevard, Overland Park, Kansas 66211 (913-339-3000).

The purpose of the annual meeting is to consider and take action on the following:

| 1. | Election of |

| 2. | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for |

| 3. | Approval of an amendment to the 1988 Employees Stock Purchase Plan to increase the authorized number of shares available for purchase; |

| 4. | Vote on |

| Any other business that properly comes before the meeting. |

ThisLike last year, we are taking advantage of new Securities and Exchange Commission rules that allow us to furnish proxy materials to you via the Internet. Unless you have already requested to receive a printed set of proxy materials, you will receive a Notice Regarding the Availability of Proxy Material, or Notice. The Notice contains instructions on how to access proxy materials and vote your shares via the Internet or, if you prefer, to request a printed set of proxy materials at no additional cost to you. We believe that this new approach will provideprovides a convenient way for you to access your proxy materials and vote your shares, while lowering our printing and delivery costs and reducing the environmental impact associated with our annual meeting.

Shareholders of record as of March 14, 200813, 2009 can vote at the annual meeting. On or about March 31, 2008,2009, we will mail the Notice or, for shareholders who have already requested to receive a printed set of proxy materials, this proxy statement, the accompanying proxy card and the annual report on Form 10-K for the year ended December 31, 2007.2008. Please vote before the annual meeting in one of the following ways:

| 1. | By Internet—You can vote over the Internet atwww.proxyvote.com by entering the control number found on your Notice or proxy card; |

| 2. | By Telephone—You can vote by telephone by calling 1-800-690-6903 and entering the control number found on your Notice or proxy card; or |

| 3. | By Mail—If you received your proxy materials by mail, you can vote by signing, dating and mailing the proxy card in the pre-paid enclosed envelope. |

Your vote is very important. Please vote before the meeting using one of the methods above to ensure that your vote will be counted. Your proxy may be revoked at any time before the vote at the annual meeting by following the procedures outlined in the accompanying proxy statement.

| By order of the Board of Directors, |

|

James H. Hance, Jr. |

Chairman of the Board of Directors |

Overland Park, Kansas

March 27, 200830, 2009

| 3 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 5 | ||

Voting by Our Employees Participating in the Sprint Nextel 401(k) Plan | ||

Delivery of Proxy Materials to Households Where Two or More Shareholders Reside | 6 | |

| 6 | ||

| 7 | ||

| 7 | ||

| 25 | ||

| 26 | ||

| 26 | ||

| 26 | ||

| 44 | ||

| 51 | ||

Potential Payments Upon Termination of Employment or Change of Control | ||

Proposal 2—Ratification of Independent Registered Public Accounting Firm | ||

Proposal 3—Approval of an Amendment to the 1988 Employees Stock Purchase Plan | 69 | |

Proposal 4—Shareholder Proposal Concerning Special Shareholder Meetings | ||

Proposal 5—Shareholder Proposal Concerning Political Contributions | 74 | |

| A-1 | ||

General Information About Proxies and Voting

These proxy materials are delivered in connection with the solicitation by our board of directors of proxies to be voted at our annual meeting of shareholders, which will be held at The Hyatt Regency Reston, 1800 Presidents Street, Reston, Virginia 20190Overland Park Convention Center, 6000 College Boulevard, Overland Park, Kansas 66211 at 10:00 a.m. EasternCentral time on Tuesday, May 13, 2008.12, 2009. On or about March 31, 2008,2009, we mailed to our shareholders entitled to vote at the meeting the Notice or, for shareholders who have already requested to receive printed materials, this proxy statement and the form of proxy. Our principal executive offices are located at 6200 Sprint Parkway, Overland Park, Kansas 66251.

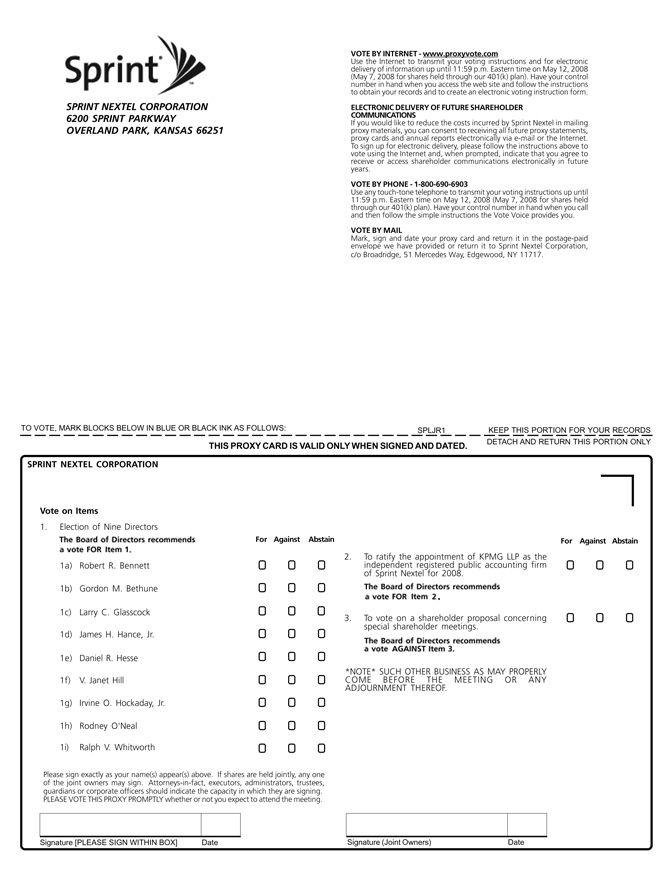

At the annual meeting, shareholders will be asked to:

elect nineten directors to serve for a term of one year (Item 1 on the proxy card);

ratify the appointment of KPMG LLP as our independent registered public accounting firm for 20082009 (Item 2 on the proxy card);

vote on an amendment to the 1988 Employees Stock Purchase Plan to increase the authorized number of shares available for purchase (Item 3 on the proxy card);

vote on a shareholder proposal concerning special shareholder meetings, if presented at the meeting (Item 34 on the proxy card);

vote on a shareholder proposal concerning political contributions, if presented at the meeting (Item 5 on the proxy card); and

take action on any other business that properly comes before the meeting and any adjournment or postponement of the meeting.

Record Date; Shareholders Entitled to Vote

The close of business on March 14, 200813, 2009 has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the 20082009 annual meeting or any adjournments or postponements of the 20082009 annual meeting.

As of the record date, the following shares were outstanding and entitled to vote:

Designation | Outstanding | Votes per Share | Outstanding | Votes per Share | ||||

Series 1 common stock | 2,774,213,326 | 1.0000 | 2,790,132,789 | 1.0000 | ||||

Series 2 common stock | 74,831,333 | 0.1000 | 74,831,333 | 0.1000 |

The relative voting power of our different series of voting stock is set forth in our articles of incorporation.

A complete list of shareholders entitled to vote at the 20082009 annual meeting will be available for examination by any shareholder at 2001 Edmund Halley Drive, Reston, Virginia 20191,6200 Sprint Parkway, Overland Park, Kansas 66251, for purposes pertaining to the 20082009 annual meeting, during normal business hours for a period of ten days before the annual meeting, and at the time and place of the annual meeting.

In order to carry on the business of the meeting, we must have a quorum. A quorum requires the presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the meeting. We count

abstentions and broker “non-votes” as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a shareholder fails to provide voting instructions to his or her broker for shares held in “street name.” Under those circumstances, a shareholder’s broker may be authorized to vote for the shareholder on some routine items, but is prohibited from voting on other items. Those items for which a shareholder’s broker cannot vote result in broker “non-votes.”

Required Vote to Elect the Directors (Proposal 1; Item 1 on the Proxy Card)

Each of the nineten nominees for director will be elected as a director if the votes cast for each such nominee exceed the number of votes against that nominee, assuming that there is a quorum represented at the annual meeting. A summary of our majority voting standard appears on page 24 under “Proposal 1—Election of Directors—Board Committees and Director Meetings—The Nominating and Corporate Governance Committee—Majority Voting.”

Required Vote to Ratify the Appointment of our Independent Registered Public Accounting Firm (Proposal 2; Item 2 on the Proxy Card)

The affirmative vote of a majority of votes cast in person or by proxy by holders of our common stock entitled to vote on the matter is required to ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2008.2009.

Required Vote to Approve the Shareholder ProposalAmendment to the 1988 Employees Stock Purchase Plan (Proposal 3; Item 3 on the Proxy Card)

The affirmative vote of a majority of votes cast in person or by proxy by holders of our common stock entitled to vote on the matter is required to approve the management proposal concerning an amendment to the 1988 Employees Stock Purchase Plan.

Required Vote to Approve the Shareholder Proposals (Proposals 4 and 5; Items 4 and 5 on the Proxy Card)

The affirmative vote of a majority of votes cast in person or by proxy by holders of our common stock entitled to vote on the matter is required to approve the shareholder proposal,proposals, if presented at the annual meeting.

Treatment of Abstentions, Not Voting and Incomplete Proxies

If a shareholder marks the “Abstain” box, it will have no effect on the vote for Proposal 1, but it will have the same effect as a vote against Proposals 2 and 3.through 5. If a shareholder does not return a proxy, it will have no effect on the vote for the proposals. Broker non-votes for non-routine proposals will also have no effect on the vote for the proposals. Except for broker non-votes, if a proxy is returned without indication as to how to vote, the stock represented by that proxy will be considered to be voted in favor of Proposals 1, 2 and 2,3, and voted against Proposal 3.Proposals 4 and 5.

Giving a proxy means that you authorize the persons named in the proxy card to vote your shares at the 20082009 annual meeting in the manner directed. You may vote by proxy or in person at the meeting. To vote by proxy, you may use one of the following methods if you are a registered holder (that is, you hold our stock in your own name):

| • | By Internet—You can vote over the Internet atwww.proxyvote.com by entering the control number found on your Notice or proxy card; |

By Telephone—You can vote by telephone by calling 1-800-690-6903 and entering the control number found on your Notice or proxy card; or

By Mail—If you received your proxy materials by mail, you can vote by signing, dating and mailing the proxy card in the pre-paid enclosed envelope.

We request that shareholders vote as soon as possible. When the proxy is properly returned, the shares of stock represented by the proxy will be voted at the 20082009 annual meeting in accordance with the instructions contained in the proxy.

Except for broker non-votes, if any proxy is returned without indication as to how to vote, the stock represented by the proxy will be considered to be voted in favor of Proposals 1, 2 and 2,3, and voted against Proposal 3.Proposals 4 and 5. Unless a shareholder checks the box on the proxy card to withhold discretionary authority, the proxies may use their discretion to vote on other matters introduced at the 20082009 annual meeting.

If a shareholder’s shares are held in “street name” by a broker or other nominee, the shareholder should check the voting form used by that firm to determine whether the shareholder may provide voting instructions to the broker or other nominee by telephone or the Internet.

Every shareholder’s vote is important. Accordingly, you should vote via the Internet or by telephone; sign, date and return the enclosed proxy card if you received it by mail; or provide instructions to your broker or other nominee whether or not you plan to attend the annual meeting in person.

Revocability of Proxies and Changes to a Shareholder’s Vote

A shareholder has the power to revoke his or her proxy or change his or her vote at any time before the proxy is voted at the annual meeting. You can revoke your proxy or change your vote in one of four ways:

by sending a signed notice of revocation to our corporate secretary to revoke your proxy;

by sending to our corporate secretary a completed proxy card bearing a later date than your original proxy indicating the change in your vote;

| • | by logging on towww.proxyvote.com in the same manner you would to submit your proxy electronically or calling 1-800-690-6903, and in each case following the instructions to revoke or change your vote; or |

by attending the annual meeting and voting in person, which will automatically cancel any proxy previously given, or by revoking your proxy in person, but attendance alone will not revoke any proxy that you have given previously.

If you choose any of the first three methods, you must take the described action no later than the beginning of the 20082009 annual meeting. Once voting on a particular matter is completed at the annual meeting, you will not be able to revoke your proxy or change your vote as to that matter. If your shares are held in street name by a broker, bank or other financial institution, you must contact that institution to change your vote.

This solicitation is made on behalf of our board of directors, and we will pay the cost and expenses of printing and mailing this proxy statement and soliciting and obtaining the proxies, including the cost of reimbursing brokers, banks and other financial institutions for forwarding proxy materials to their customers. Proxies may be solicited, without extra compensation, by our officers and employees by mail, telephone, fax, personal interviews or other methods of communication. We have engaged the firm of Georgeson Shareholder Communications, Inc. to assist us in the distribution and solicitation of proxies and will pay Georgeson a fee of $25,000$9,000 plus out-of-pocket expenses for its services.

Voting by Our Employees Participating in the Sprint Nextel 401(k) Plan

If you are an employee of Sprint Nextel who has a right to vote shares acquired through your participation in our 401(k) plan, you are entitled to instruct the trustee, Fidelity Management Trust Company, how to vote the shares allocated to your account. The trustee will vote those shares as you instruct. You will receive voting information that covers any shares held in your 401(k) plan account, as well as any other shares registered in your own name.

If you do not instruct the trustee how to vote your shares, the 401(k) plan provides for the trustee to vote those shares in the same proportion as the shares for which it receives instructions from all other participants. To allow sufficient time for the trustee to vote, your voting instructions must be received by the trustee by May 8, 2008.7, 2009.

Delivery of Proxy Materials to Households Where Two or More Shareholders Reside

Rules of the Securities and Exchange Commission, or SEC, allow us to deliver multiple Notices in a single envelope or a single copy of an annual report and proxy statement to any household where two or more shareholders reside if we believe the shareholders are members of the same family. This rule benefits shareholders by reducing the volume of duplicate information they receive at their households. It also benefits us by reducing our printing and mailing costs.

We mailed Notices in a single envelope, or a single set of proxy materials, as applicable, to each household this year unless the shareholders in these households provided instructions to the contrary in response to a notice previously mailed to them. However, for shareholders who previously requested a printed set of the proxy materials, we mailed each shareholder in a single household a separate proxy card or voting instruction form. If you prefer to receive your own copy of the proxy materials for this or future annual meetings and you are a registered holder, you may request a duplicate set by writing to Sprint Nextel Shareholder Relations, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B424, Overland Park, Kansas 66251 or by email atshareholder.relations@sprint.com, or by calling 913-794-1091, and we will promptly furnish such materials. If a broker or other nominee holds your shares, you may instruct your broker to send duplicate mailings by following the instructions on your voting instruction form or by contacting your broker.

If you share a household address with another shareholder, and you receive duplicate mailings of the proxy materials this year, you may request that your household receive a single set of proxy materials in the future. If you are a registered holder, please contact Sprint Nextel Shareholder Relations.Relations using one of the contact methods described above. If a broker or other nominee holds your shares, you should follow the instructions on your voting instruction form or contact your broker.

If you hold some shares as a registered holder or through our 401(k) plan, and other shares in the name of a broker or other nominee, we must send you proxy materials for each account. To avoid receiving duplicate sets of proxy materials, you may consolidate accounts or consent to electronic delivery as described in the following section.

Electronic Delivery of the Proxy Materials

We are able to distribute the annual report and proxy statement to shareholders in a fast and efficient manner via the Internet. This reduces the amount of paper delivered to a shareholder’s address and eliminates the cost of sending these documents by mail. You may elect to view all future annual reports and proxy statements on the Internet instead of receiving them by mail. Alternatively, you may elect to receive all future annual reports and proxy statements by mail instead of viewing them via the Internet. To make an election, please log on towww.proxyvote.com and enter your control number.

If you have enrolled for electronic delivery, you will receive an email notice of shareholder meetings. The email will provide links to our annual report and our proxy statement. These documents are in PDF format so you will need Adobe Acrobat® Reader to view these documents on-line, which you can download for free by visiting www.adobe.com. The email will also provide a link to a voting web site and a control number to use to vote via the Internet.

Your votes are kept confidential from our directors, officers and employees, subject to certain specific and limited exceptions. One exception occurs if you write opinions or comments on your proxy card. In that case, a copy of the proxy card is sent to us.

Shareholders, their guests and persons holding proxies from shareholders may attend the annual meeting. Seating, however, is limited and will be available on a first-come, first-served basis. If you plan to attend the meeting, please bring proof of ownership to the meeting. A brokerage account statement showing that you owned our stock on March 14, 200813, 2009 is acceptable proof.

Conference Call and Audio Webcast

Shareholders may listen live by phone or audio webcast to our annual meeting. The dial-in numbers for the conference call will be posted atwww.sprint.com/investors/shareholders/annualmeetingbefore the meeting. Lines are limited and will be available on a first-come, first-served basis. Shareholders may access the audio webcast of our annual meeting at the same web address. This is an audio-only webcast with no video or other materials.

Security Ownership of Certain Beneficial Owners

The following table provides information about the only known beneficial owners of five percent or more of our voting common stock based on our stock outstanding at March 14, 2008.13, 2009.

For purposes of the table below, beneficial ownership is determined based on Rule 13d-3 of the Securities Exchange Act of 1934, which states that a beneficial owner is any person who directly or indirectly has or shares voting and/or investment/dispositive power. According to a Schedule 13G filed on February 11, 2008 by The Growth Fund of America, Inc., or GFA, GFA has sole voting power with respect to all of the shares and sole dispositive power with respect to none of the shares listed by its name in the table below. All shares held by GFA are subject to the sole dispositive power of either Capital Research Global Investors, or CRGI, or Capital World Investors, or CWI. Accordingly, shares held by GFA over which CRGI or CWI has sole dispositive power are included in the respective totals for CRGI and CWI.

|

|

| |||||

|

| ||||||

| |||||||

| |||||||

Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent | |||||

Common Stock | AXA Financial, Inc. 1290 Avenue of the Americas New York, New York 10104 | 234,347,139 shares | (1) | 8.4 | % | |||

Dodge & Cox 555 California Street, 40th Floor San Francisco, CA 94104 | 195,440,413 shares | (2) | 7.0 | % | ||||

Capital Research Global Investors 333 South Hope Street | 183,444,340 shares | (3) | 6.6 | % | ||||

Bank of New York Mellon Corporation One Wall Street, 31st Floor New York, New York 10286 | 181,190,287 shares | (4) | 6.5 | % | ||||

Barclay’s Global Investors, NA 400 Howard Street San Francisco, California 94105 | 160,430,126 shares | (5) | 5.7 | % | ||||

| (1) | According to a Schedule |

| (2) | According to a Schedule 13G filed with the SEC on February 11, |

| (3) | According to a Schedule |

| (4) | According to a Schedule 13G filed with the SEC on February 17, 2009 by The Bank of New York Mellon Corporation, MBC Investments Corporation, Neptune LLC, Mellon International Holding S.AR.L., Mellon International Ltd., Newton Management Ltd. and Newton Investment Management Ltd. According to the Schedule 13G, Bank of New York Mellon Corporation is the beneficial owners of, and has sole voting power with respect to 168,536,609 shares, and sole dispositive power with respect to 180,242,370 shares. |

| (5) | According to a Schedule 13G filed with the SEC on February 5, 2009 by Barclays Global Investors, NA, Barclays Global Fund Advisors, Barclays Global Investors, LTD, Barclays Global Investors Japan Limited, Barclays Global Investors Canada Limited, Barclays Global Investors Australia Limited and Barclays Global Investors (Deutschland) AG. According to the Schedule 13G, these investors aggregately are the beneficial owners of, and have sole voting power with respect to 137,918,524 shares, and sole dispositive power with respect to all of the shares. |

Security Ownership of Directors and Executive Officers

The following table states the number of shares of our series 1 common stock beneficially owned as of March 14, 200813, 2009 by each current director, current named executive officer and all current directors and executive officers as a group. Except as otherwise indicated, each individual named has sole investment and voting power with respect to the shares owned.

Name of Beneficial Owner | Shares Owned | Shares Covered by Exercisable Options and RSUs to be Delivered(1) | Shares Represented by RSUs(2) | Percentage of Common Stock | Shares Owned | Shares Covered by Exercisable Options and RSUs to be Delivered(1) | Shares Represented by RSUs(2) | Percentage of Common Stock | ||||||||||||

Keith J. Bane | 7,908 | 26,581 | 0 | * | ||||||||||||||||

Mark E. Angelino | 7,579 | (3) | 305,984 | 0 | * | |||||||||||||||

William G. Arendt | 98,260 | (3) | 300,357 | 26,756 | * | |||||||||||||||

Robert R. Bennett | 23,776 | 5,221 | 0 | * | 28,997 | 14,815 | 0 | * | ||||||||||||

Gordon M. Bethune | 12,294 | 5,221 | 0 | * | 17,515 | 14,815 | 0 | * | ||||||||||||

Frank M. Drendel | 111,139 | 227,029 | 0 | * | ||||||||||||||||

Robert H. Brust | 2,985 | 0 | 469,484 | * | ||||||||||||||||

Keith O. Cowan | 125,429 | 538,939 | 558,144 | * | ||||||||||||||||

Steven L. Elfman | 89,326 | 228,666 | 361,599 | * | ||||||||||||||||

Larry C. Glasscock | 1,000 | 3,649 | 0 | * | 33,946 | 14,815 | 0 | * | ||||||||||||

James J. Hance, Jr. | 33,234 | 5,221 | 0 | * | 38,455 | 14,815 | 0 | * | ||||||||||||

Daniel R. Hesse | 0 | 0 | 718,907 | * | 486,210 | 1,853,886 | 1,254,498 | * | ||||||||||||

V. Janet Hill | 13,907 | 177,694 | 0 | * | 19,128 | 187,288 | 0 | * | ||||||||||||

Irvine O. Hockaday, Jr. | 95,437 | 54,816 | 0 | * | 126,902 | 50,717 | 0 | * | ||||||||||||

Linda Koch Lorimer | 46,035 | 44,054 | 0 | * | ||||||||||||||||

Frank Ianna | 5,000 | 8,609 | 0 | * | ||||||||||||||||

Robert L. Johnson | 71,712 | 495,988 | 161,377 | * | ||||||||||||||||

Leonard J. Kennedy | 4,044 | (3) | 620,077 | 61,155 | * | |||||||||||||||

Sven-Christer Nilsson | 0 | 10,144 | 0 | * | ||||||||||||||||

William R. Nuti | 0 | 10,965 | 0 | * | ||||||||||||||||

Rodney O’Neal | 0 | 3,649 | 0 | * | 3,649 | 14,815 | 0 | * | ||||||||||||

William H. Swanson | 28,564 | 5,221 | 0 | * | ||||||||||||||||

Kathryn A. Walker | 132,888 | 629,457 | 257,062 | (3) | * | |||||||||||||||

Barry J. West | 0 | 770,856 | 0 | * | ||||||||||||||||

Ralph V. Whitworth | 53,076,834 | (4) | 2,226 | 0 | 1.9 | % | ||||||||||||||

Paul N. Saleh | 403,556 | (3) | 0 | 191,110 | * | |||||||||||||||

Directors and Executive Officers as a group (21 persons) | 53,664,063 | 3,605,063 | 1,621,887 | 1.9 | % | |||||||||||||||

Directors and Executive Officers as a group (22 persons) | 1,660,298 | 5,198,872 | 3,318,147 | * | ||||||||||||||||

| * | Indicates ownership of less than 1%. |

| (1) | Represents shares that may be acquired upon the exercise of stock options exercisable, and shares of stock that underlie restricted stock units to be delivered, on or within 60 days after March |

| (2) | Represents unvested restricted stock units with respect to which we will issue the underlying shares of our common stock after the units vest. There are no voting rights with respect to these restricted stock units. These amounts do not include any restricted stock units covered by footnote 1. |

| (3) |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file with the SEC and the New York Stock Exchange, or NYSE, initial reports of beneficial ownership and reports of changes in beneficial ownership of our common stock and other equity securities. These people are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file, and we make these reports available atwww.sprint.com/investors/sec.

To our knowledge, based solely on a review of the copies of these reports furnished to us and written representations that no other reports were required, during 20072008 all Section 16(a) filing requirements applicable to our directors, executive officers and beneficial owners of more than 10% of our equity securities were met, except for: one late Form 4 filing in February 2007 for an acquisition of share units in connection with our Deferred Compensation Plan by Linda Koch Lorimer, an outside director, one late Form 4 filing in March 2007 for a disposition of shares by Barry J. West, Chief Technology Officer & President—4G Mobile Broadband and one late Form 4 filing in December 2007 for an acquisition of shares by Larry C. Glasscock, an outside director.met.

Proposal 1. Election of Directors

(Item 1 on Proxy Card)

We currently have 1311 seats on our board. Keith J. Bane, Frank M. Drendel, Linda Koch Lorimer and William H. Swanson areIrvine O. Hockaday, Jr. is not standing for re-election. The board has reduced the number of seats on our board to nineten effective as of the time of our annual meeting. The board’s objective is to increase the number of board seats and add new directors who meet the director selection criteria and have the skills and attributes that meet the current needs of the board. There is an ongoing director search underway.

Each of the nineten nominees, if elected, will serve one year until the 20092010 annual meeting and until a successor has been elected and qualified. The persons named in the accompanying proxy will vote for the election of the nominees named below unless a shareholder directs otherwise. Each nominee has consented to be named and to continue to serve if elected. If any of the nominees becomes unavailable for election for any reason, the proxies will be voted for the other nominees and for any substitutes.

Robert R. Bennett, age |  | |

Gordon M. Bethune, age |   | |

Larry C. Glasscock,age |  | |

James H. Hance, Jr., age |   | |

Daniel R. Hesse, age |  | |

V. Janet Hill, age |  | |

|  | |

Sven-Christer Nilsson, age 64. Owner and Founder, Ripasso AB, Ängelholm, Sweden, a private business advisory company. Mr. Nilsson serves as an advisor and board member for companies throughout the world. He previously served in various executive positions for The Ericsson Group from 1982 through 1999, including as its President and Chief Executive Officer from 1998 through 1999. Mr. Nilsson is a director of |  | |

William R. Nuti, age 45. Chairman of the Board, Chief Executive Officer and President of NCR Corporation, a |   | |

Rodney O’Neal, age |  | |

|  | |

Our boardBoard of directorsDirectors recommends that you voteforthe election of the nineten nominees for director in this Proposal 1.

DirectorsDirector Not Standing for Re-Election

The following information is given with respect to Messrs. Bane, Drendel and Swanson and Ms. Lorimer,Irvine O. Hockaday, Jr. who areis not standing for re-election at our annual meeting. Messrs. Bane, Drendel and Swanson and Ms. LorimerMr. Hockaday will continue to serve on our board until the annual meeting.

|  | |

|  | |

|  | |

|   | |

The following table provides compensation information for our current and former directors who served during 2007.2008. Because Mr. Whitworth’sIanna’s service did not commence until February 2008.March 2009, he is not listed in the table below. Compensation information for Mr. Hesse, our President and Chief Executive Officer, and Gary D. Forsee, our former Chairman, President and Chief Executive Officer, can be found in the “Executive Compensation” section of this proxy statement.

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(4) | Option Awards ($)(4) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation ($)(5) | Total ($) | Fees Earned or Paid in Cash (1)($) | Stock Awards (2)($) | Option Awards (2)($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation (3)($) | Total ($) | ||||||||||||||||

Keith J. Bane | 127,000 | 107,771 | — | — | — | 6,065 | 240,836 | |||||||||||||||||||||||

Robert R. Bennett | 148,000 | 138,662 | — | — | — | — | 286,662 | 136,000 | 129,516 | — | — | — | — | 265,516 | ||||||||||||||||

Gordon M. Bethune | 109,000 | 135,852 | — | — | — | 213 | 245,065 | 129,375 | 132,015 | — | — | — | 3,369 | 264,759 | ||||||||||||||||

Frank M. Drendel | 102,000 | 107,771 | — | — | — | 541 | 210,312 | |||||||||||||||||||||||

Larry C. Glasscock(2) | 46,167 | 32,685 | — | — | — | — | 78,852 | |||||||||||||||||||||||

Larry C. Glasscock | 132,000 | (4) | 125,864 | — | — | — | — | 257,864 | ||||||||||||||||||||||

James H. Hance, Jr. | 164,625 | 161,730 | — | — | — | 4,180 | 330,535 | 299,000 | 131,899 | — | — | — | 5,137 | 436,036 | ||||||||||||||||

V. Janet Hill | 128,000 | 107,771 | — | — | — | 489 | 236,260 | 121,000 | 129,516 | — | — | — | 174 | 250,690 | ||||||||||||||||

Irvine O. Hockaday, Jr. | 202,375 | (3) | 134,078 | — | — | — | 5,503 | 341,956 | 114,000 | (4) | 132,015 | — | — | — | 5,179 | 251,194 | ||||||||||||||

Linda Koch Lorimer | 117,000 | (3) | 134,078 | — | — | — | 474 | 251,552 | ||||||||||||||||||||||

Rodney O’Neal(2) | 45,167 | 32,685 | — | — | — | — | 77,852 | |||||||||||||||||||||||

William H. Swanson | 156,000 | (3) | 131,974 | — | — | — | 480 | 288,454 | ||||||||||||||||||||||

Sven-Christer Nilsson(5) | 13,667 | 32,765 | — | — | — | — | 46,432 | |||||||||||||||||||||||

William R. Nuti(6) | 53,833 | 55,389 | — | — | — | — | 109,222 | |||||||||||||||||||||||

Rodney O’Neal | 117,000 | 125,864 | — | — | — | — | 242,864 | |||||||||||||||||||||||

Former Directors | ||||||||||||||||||||||||||||||

Keith J. Bane(7) | 55,250 | 44,508 | — | — | — | 2,194 | 101,952 | |||||||||||||||||||||||

Frank M. Drendel(7) | 41,250 | 44,508 | — | — | — | 985 | 86,743 | |||||||||||||||||||||||

Linda Koch Lorimer(7) | 43,250 | (4) | 47,007 | — | — | — | 879 | 91,136 | ||||||||||||||||||||||

William H. Swanson(7) | 56,875 | (4) | 47,007 | — | — | — | 5,890 | 109,772 | ||||||||||||||||||||||

Ralph V. Whitworth(8) | 99,583 | 21,659 | — | — | — | — | 119,437 | |||||||||||||||||||||||

| (1) | Includes annual retainer fees; |

| (2) | Represents the compensation costs of |

| On May 13, 2008, we issued 14,815 restricted stock units, or RSUs, to each of our outside directors serving on the board at the time in connection with their annual RSU grant for 2008. The grant date fair market value of the 2008 RSU grant to each of our outside directors is $134,224, which is the product of the per share grant date fair market value multiplied by the number of RSUs granted. To determine the grant date fair market value, we used the trading price of our common stock at the close of market on the May 13, 2008 grant date. |

| The number of RSUs granted to each of our outside directors was calculated by dividing the director’s annual RSU grant value of $100,000 by $6.75, which was the 30-calendar day stock price average for our common stock beginning on March 27, 2008 and ending on April 25, 2008. |

Any new outside director joining the board receives a grant of prorated RSUs upon his or her appointment. The methodology for determining the number of potential RSUs awarded is described on page 17 under “—Restricted Stock Units.” Three directors received a grant of prorated RSUs upon joining the board in 2008. On February 11, 2008, the board’s Compensation Committee granted 2,226 RSUs to Mr. Whitworth. |

On June 9, 2008, the board’s Compensation Committee granted 10,965 RSUs to Mr. Nuti. On November 5, 2008, the board’s Compensation Committee granted 10,144 RSUs to Mr. Nilsson, with such grant becoming effective as of November 10, 2008, which was the effective date of Mr. Nilsson’s board appointment. |

| As of December 31, 2008, the outside directors held stock awards in the form of RSUs as set forth in the following table: |

Name | Aggregate Number of Sprint Nextel RSUs Outstanding at December 31, 2008 | |

Robert R. Bennett | 14,815 | |

Gordon M. Bethune | 14,815 | |

Larry C. Glasscock | 14,815 | |

James H. Hance, Jr. | 14,815 | |

V. Janet Hill | 14,815 | |

Irvine O. Hockaday, Jr. | 14,815 | |

Sven-Christer Nilsson | 10,144 | |

William R. Nuti | 10,965 | |

Rodney O’Neal | 14,815 | |

Former Directors | ||

Keith J. Bane | — | |

Frank M. Drendel | — | |

Linda Koch Lorimer | — | |

William H. Swanson | — | |

Ralph V. Whitworth | — |

| Although we issued no cash dividends in 2008, it is our policy that any cash dividend equivalents on the RSUs granted to the outside directors are reinvested into RSUs, which vest when the underlying RSUs vest. The aggregate number of RSUs disclosed in this table includes the dividend accruals on the underlying RSUs, if any. This table reflects the number of stock awards outstanding as of December 31, 2008 attributable to compensation paid by us to our directors. |

| As of December 31, 2008, the outside directors held outstanding option awards, all of which are vested, as set forth in the following table: |

Name | Aggregate Number of Shares Underlying Sprint Nextel Option Awards Outstanding at December 31, 2008 | |

Robert R. Bennett | — | |

Gordon M. Bethune | — | |

Larry C. Glasscock | — | |

James H. Hance, Jr. | — | |

V. Janet Hill | 172,473 | |

Irvine O. Hockaday, Jr. | 44,118 | |

Sven-Christer Nilsson | — | |

William R. Nuti | — | |

Rodney O’Neal | — | |

Former Directors | ||

Keith J. Bane | — | |

Frank M. Drendel | — | |

Linda Koch Lorimer | 33,356 | |

William H. Swanson | — | |

Ralph V. Whitworth | — |

| This table includes options granted to Mr. Hockaday and Ms. Lorimer under Sprint’s 1997 Long-Term Stock Incentive Program in February 2002. Options granted to Mrs. Hill were granted under the Nextel incentive equity plan prior to the Sprint-Nextel merger. Since the merger, we have not issued stock options to our outside directors as part of our outside director compensation program. |

| (3) | Consists of tax gross-up payments made in 2008 for certain benefits provided in 2007, tax gross-up payments made in 2009 for certain benefits provided in 2008 and charitable matching contributions in 2008 of $2,500 made with respect to Mr. Bethune and $5,000 made with respect to each of Messrs. Hance, Hockaday and Swanson. Our Sprint Foundation matching gift program and other benefits are described below on page 17. Beginning in 2006, no tax gross-ups are provided on the value of communications services and equipment utilized by our outside board members. |

| (4) | Messrs. Glasscock, Hockaday and Swanson participated in our Directors’ Shares Plan in |

|

|

Name | Aggregate Number of Sprint Nextel RSUs Outstanding at December 31, 2007 | Aggregate Number of Embarq RSUs Outstanding at December 31, 2007 | ||

Keith J. Bane | 5,221 | — | ||

Robert R. Bennett | 5,221 | — | ||

Gordon M. Bethune | 9,008 | 198 | ||

Frank M. Drendel | 5,221 | — | ||

Larry C. Glasscock | 3,649 | — | ||

James H. Hance, Jr. | 9,008 | 197 | ||

V. Janet Hill | 5,221 | — | ||

Irvine O. Hockaday, Jr. | 9,008 | 198 | ||

Linda Koch Lorimer | 9,008 | 198 | ||

Rodney O’Neal | 3,649 | — | ||

William H. Swanson | 9,008 | 198 |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

|

|

| (5) |

| (6) | Mr. Nuti joined our board on June 9, 2008. |

| (7) | Messrs. Bane, Drendel and |

| (8) | Mr. |

Our outside directors are directors who are not employees of our company. The compensation of our outside directors is partially equity-based and is designed to comply with ourCorporate Governance Guidelines, which provide that the guiding principles behind our outside director compensation practices are: (1) alignment with shareholder interests, (2) preservation of outside director independence and (3) preservation of the fiduciary duties owed to all shareholders. Our outside directors are directors who are not employees of our company.

Mr. Hance, our Chairman, received a prorated portion of the $75,000 Lead Independent Director annual retainer for the period beginning October 8, 2007 (when the Lead Independent Director position was combined with the Chairman position) and ending December 31, 2007. In February 2008, our board approved the payment of a $150,000 annual retainer to Mr. Hance, as described below, which is being paid to him in lieu of the former Lead Independent Director retainer. Our outside directors are also reimbursed for direct expenses relating to their activities as members of our board of directors.

Annual Retainers, Additional Retainers and Meeting Fees

Our outside directors are each paid $70,000 annually plus meeting fees and the following additional retainers:

For 2007, the Lead Independent Director was entitled to receiveChairman receives an additional annual retainer of $75,000; effective January 1, 2008, the Chairman is entitled to receive an additional annual retainer of $150,000; the Lead Independent Director retainer has been eliminated;

the Chair of the Audit Committee receives an additional annual retainer of $20,000;

the Chair of the Human Capital and Compensation Committee or HC&CC, receives an additional annual retainer of $15,000; and

the Chairs of the Finance Committee and the Nominating and Corporate Governance Committee each receive an additional annual retainer of $10,000.

For each meeting attended, we pay our outside directors the following fees:

$2,000 for in-person board and committee meetings; and

$1,000 for board and committee meetings held telephonically.

As discussed above, our directors are entitled to participate in our Deferred Compensation Plan, a nonqualified and unfunded plan under which our outside directors can defer receipt of all or part of their annual and additional retainer fees and meeting fees into various investment funds and stock indices, including a fund that tracks our common stock. In 2007,2008, Ms. Lorimer participated in our Deferred Compensation Plan. Also, as discussed above, our directors may participate in our Directors’ Shares Plan, under which they can elect to use all or part of their annual and additional retainer fees and meeting fees to purchase shares of our common stock in lieu of receiving cash payments. Our outside directors can also elect to defer receipt of these shares. In 2007, 2008,

Messrs. Glasscock, Hockaday and Swanson participated in our Directors’ Shares Plan. On an annual basis, our outside directors are given the opportunity to either enroll in or discontinue their participation in one or both of these plans.

Restricted Stock Units

Each of our outside directors receives ana targeted annual grant of $100,000 in RSUs representing shares of our common stock. Generally, the RSUs are granted each year aton the date of the annual meeting of shareholders and each grant vests in full upon the subsequent annual meeting. On June 26, 2007, our board revised the director compensation program to provide anyAny new outside board member joining the board on or after June 26, 2007 withreceives a grant of prorated RSUs upon his or her appointment that vestvests in full upon the subsequent annual meeting. The dollar value of the outside directors’ targeted annual grant ($100,000) is prorated for the time period between the date of the director’s initial appointment to the board and the date of the subsequent annual meeting. The prorated RSU grant is intended to offer a more competitive compensation package to our outside directors, immediately align the interests of outside directors with our shareholders’ interests, and be more consistent with the manner in which the cash retainers are paid.paid upon an outside director joining the board.

Stock Ownership Guidelines

Our director stock ownership guidelines require our outside directors to hold equity or equity interests in our common stock with a value of at least $140,000, which is two times the annual retainer fee. Each outside director is expected to meet this ownership level by the second anniversary of the director’s initial election or appointment to the board. Our director stock ownership guidelines provide the board with flexibility to grant exceptions based on its consideration of individual circumstances. AllAs of December 31, 2008, of our current outside directors who have served on our board for two or more years, areone was in compliance with our director stock ownership guidelines and five were not in compliance with our director stock ownership guidelines due to the reduction in our share price that occurred during 2008. The same stock and stock equivalents that count towards the stock ownership guidelines for our executive officers (as described below under “Executive Compensation—Compensation Discussion and Analysis”) are used to determine our outside directors’ compliance with the director stock ownership guidelines.

In addition, active outside directors are required to retain for a period of at least 12 months all shares or share equivalents (e.g., options or RSUs) received from us, except for shares (i) sold for the payment of taxes as a result of shares becoming available to the outside director or (ii) delivered to pay for the acquisition of additional shares through the exercise of a stock option or otherwise. The 12-month period begins on the date any restrictions or vesting periods have lapsed on the shares or share equivalents (including stock options). The outside directors are subject to this holding period until they leave our board.

Other Benefits

We believe that it serves the interests of our company and our shareholders to enable our outside directors to utilize our communications services. Accordingly, each outside director mayis entitled to receive up to twoan unlimited number of wireless units, and one connection cardincluding accessories, and the related wireless service, wireline long distance services and internationallong distance calling cards.cards with a maximum limit of $12,000 per year. Outside directors may also receive specialized equipment, such as a repeater or AIRAVETM device, on an as-needed basis, with equipment valued at greater than $1,000 requiring Compensation Committee approval. In addition to the value of the communications service, the value of any additional services and features (e.g.(e.g., ringers, call tones, directory assistance), and the lease value of the wireless devices, replacements and associated accessories are included in the value of the communications benefit. The value of any communications benefits realized by a director is subject to federal, state or local income taxes, which taxes are paid by the director. There may be other circumstances in which units are provided to board members (such as demonstration, field testing and training units)units, or units for use while traveling internationally); these units must be returned or they will be converted to a consumer account and applied toward the wireless units under this communications benefit once the units reach production.

Under our charitable matching gifts program, the Sprint Foundation matches contributions made to qualifying organizations on a dollar-for-dollar basis, up to the annual donor maximum of $5,000. The annual maximum contribution per donor, per organization is $2,500. As described in the director compensation table, Messrs. Bethune, Hance, Hockaday and HockadaySwanson were the only outside directors for whom the Sprint Foundation provided matching charitable contributions in 2007.2008.

Except as described in this paragraph, weWe currently do not offer retirement benefits to outside directors. Ms. Lorimer isdirectors, and none of our onlycurrent outside director who isdirectors are eligible to receive benefits under a pre-existing retirement plan originally adopted by our board of directors in 1982. The board amended thethat retirement plan in 1996 to eliminate the

retirement benefit for any outside director who did not have five years of credited service as of the date of the amendment. Ms. Lorimer was deemed as having over five years of credited service at the time the retirement benefit was eliminated as a result of her years of service on the board of Centel Corporation, with which we merged in 1993. Following her departure from our board, Ms. Lorimer will receive monthly benefit payments equal to the monthly fee (not including meeting fees or additional retainers) being paid to outside directors at the time of her retirement. The monthly retirement benefit would be $5,833 while the current $70,000 annual retainer remains in effect, and the number of monthly benefit payments to Ms. Lorimer will be 120 payments.

Our board and senior management devote considerable time and attention to corporate governance matters. We maintain a comprehensive set of corporate governance initiatives that include the following:

maintaining a Corporate Governance and Ethics organization that is functionally independent from our other operating units and is designed to provide an enhanced level of transparency into the company for all of our stakeholders;

refinement of our policies and goals with respect to the determination of executive compensation programs, including increasing emphasis on performance-based equity compensation, as further described below under “Executive Compensation—Compensation Discussion and Analysis;”

implementing a majority vote standard in an uncontested election of directors;

implementing an executive compensation clawback policy, which is discussed on page 40;

implementing a policy regarding independent executive consultants, which is discussed on page 27;

conducting annual board, committee and director self evaluations;

declassification of the board;

adherence to strict independence standards for directors that meet or exceed NYSE listing standards;

requiring the outside directors to hold executive sessions without management present, no less than three times a year, at or in conjunction with regularly-scheduled board meetings;

requiring the Audit Committee, the Finance Committee, the HC&CCCompensation Committee and the Nominating and Corporate Governance Committee to be composed entirely of independent directors;

| • | publication on our website of ourCorporate Governance Guidelines and charters for all standing committees of the board, which detail important aspects of our governance policies and practices; |

maintaining limits on the number of other public company boards and audit committees on which our directors canmay serve;

maintaining a policy that prohibits our independent registered public accounting firm from providing professional services, including tax services, to any employee or board member or any of their immediate family members that would impair the independence of our independent registered public accounting firm;

maintaining stock ownership guidelines for vice presidents and above and outside directors; and

maintaining limits on payments made in any future severance agreement with any officer at the level of senior vice president or above as further described below under “Executive Compensation—Compensation Discussion and Analysis.”

We value the views of our shareholders and other interested parties. Consistent with this approach, our board has established a system to receive, track and respond to communications from shareholders and other

interested parties addressed to our board or to our outside directors. A statement regarding our board

communications policy is available atwww.sprint.com/governance.Any shareholder or other interested party who wishes to communicate with our board or our outside directors may write to Board Communications Designee, Sprint Nextel Corporation, 2001 Edmund Halley Drive, Mailstop VARESPO513-503, Reston, VA 20191,6200 Sprint Parkway, Overland Park, KS 66251, KSOPHF0302-3B424, or send an email toboardinquiries@sprint.com. Our board has instructed the Board Communications Designee to examine incoming communications to determine whether the communications are relevant to our board’s roles and responsibilities. The Board Communications Designee will review all appropriate communications and report on the communications to the chair of or the full Nominating and Corporate Governance Committee, the Chairman of our full board, or the outside directors, as appropriate. The Board Communications Designee will take additional action or respond to letters in accordance with instructions from the relevant board source. Communications relating to accounting, internal accounting controls, or auditing matters will be referred promptly to members of the Audit Committee in accordance with our policy on communications with the board of directors.

James H. Hance, Jr. currently serves as our Chairman. As detailed in ourCorporate Governance Guidelines, the responsibilities and authority of our Chairman are designed to facilitate the board’s oversight of management and ensure the appropriate flow of information between the board and management, and include the following:

determining an appropriate schedule for board meetings and seeking to ensure that the outside directors can perform their duties responsibly;responsibly while not interfering with the operations of the company;

setting agendas for board meetings, with the understanding that agenda items requested on behalf of the outside directors will be included on the agenda;

determining the quality, quantity and timeliness of the flow of information from management that is necessary for the outside directors to perform their duties effectively and responsibly, with the understanding that the outside directors will receive any information requested on their behalf by the Chairman;

coordinating, developing the agenda for, chairing and moderating meetings of the outside directors;

acting as principal liaison between outside directors and the Chief Executive Officer, or CEO, on sensitive issues and, when necessary, ensure the full discussion of those sensitive issues at board meetings;

providing input to the HC&CCCompensation Committee regarding the CEO performance and meet, along with the chair of the HC&CC,Compensation Committee, with the CEO to discuss the board’s evaluation;

| • | assisting the Nominating and Corporate Governance Committee, the board and our company’s officers in assuring compliance with and implementation of theCorporate Governance Guidelines, and providing input to the Nominating and Corporate Governance Committee on revisions to the guidelines; and |

providing input to the Nominating and Corporate Governance Committee regarding the appointment of chairs and members of the Audit Committee, the HC&CC,Compensation Committee, the Executive Committee, the Finance Committee and the Nominating and Corporate Governance Committee.

The Chairman and the other directors may, from time to time, with the CEO’s knowledge and in most instances with members of management present, meet with outside parties on issues of importance to all shareholders.

A current copy of ourCorporate Governance Guidelinesand the charters for all standing committees of the board are available atwww.sprint.com/governance.They may also be obtained by writing to Sprint Nextel Shareholder Relations, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B424, Overland Park, Kansas 66251 or by email atshareholder.relations@sprint.com.

Our board has adopted a definition of director independence that in several areas exceeds the listing standards of the NYSE. OurCorporate Governance Guidelines require that at least two-thirds of our board be independent. Under ourCorporate Governance Guidelines, our board will determine affirmatively whether a director is “independent” on an annual basis and disclose these determinations in our annual proxy statement. That determination is set forth below. A director will not be independent unless the board, considering all relevant circumstances, determines that the director does not have a material relationship with us, including any of our consolidated subsidiaries. A director will not be independent if:

during the preceding five years, the director or an immediate family member (as defined below) of the director was employed by our company;

during any 12-month period in the last three years, the director or an immediate family member of the director received more than $100,000$120,000 per year in direct compensation from us, other than excluded compensation (as defined below);

during the preceding five years, the director or an immediate family member ofyears: (1) the director was affiliated with or employed by an independent registered public accounting firm that is or was the internal or external auditor of our company; (2) the director has an immediate family member who is a current partner of such firm; (3) the director has an immediate family member who is a current employee of such firm and personally works on our audit; or (4) the director or an immediate family member was a partner or employee of such firm and personally worked on our audit within that time;

during the preceding five years, an executive officer of our company served on the compensation committee of the board of another company that concurrently employed the director or an immediate family member of the director as an executive officer;

an executive officer of our company serves on the board of a company that employs the director or an immediate family member of the director as an executive officer;

during the current or previous fiscal year, the director or an immediate family member of the director accepted any payments (other than those arising from investments in our securities, excluded compensation, or other non-discretionary compensation) from us in excess of $45,000;

the director is an employee of, or an immediate family member of the director is an executive officer of, any company to which we made, or from which we received, payments (other than those arising solely from investments in our securities) that during any of the preceding three fiscal years exceeded the greater of 2% of the other company’s consolidated gross revenues or $1,000,000; or

the director is a partner in or controlling shareholder or executive officer of any organization to which we made, or from which we received, payments (other than those arising solely from investments in our securities) that during any of the preceding three fiscal years exceeded the greater of 3% of the recipient’s (i.e., our company’s or the other organization’s) consolidated gross revenues or $200,000.

Our board may determine that a director who does not meet the standards in the fifth, sixth or eighth bullet points above nevertheless is independent. Following any such determination, our board will disclose a detailed explanation of its determination in our annual proxy statement. In no event will our board make such determination for a director for more than two consecutive years.

Our board uses the following definitions to determine director independence:

“excluded compensation” means director and committee fees and pension or other forms of deferred compensation for prior service, provided such compensation is not contingent in any way on continued service;

“executive officer” has the meaning set forth in Rule 303A.02 of the NYSE, as amended from time to time; and

“immediate family member” means any person included in such term as it is defined in Rule 303A.02 of the NYSE or the rules and regulations of the SEC.

In determining the independence of the outside directors, our board considered whether our outside directors, their immediate family members, and the companies with which they are employed as an executive officer (if applicable) have any relationships with our company that would prevent them from meeting the independence standards listed above, as well as the listing standards of the NYSE. In performing its review, our board considered the responses provided by the outside directors in their director questionnaires and determined that the following director nominees for re-election at the 20082009 Annual Meeting have no material relationship with our company and are independent using the definition described above: Mrs. Hill and Messrs. Bennett, Bethune, Glasscock, Hance, Hockaday, O’NealIanna, Nilsson, Nuti and Whitworth.O’Neal. Based on these standards, each of our outside directors who are standing for re-election are independent directors. The Audit Committee, the Finance Committee, the HC&CCCompensation Committee, and the Nominating and Corporate Governance Committee are composed entirely of independent directors.

Board Committees and Director Meetings

Board Meetings

During 2007,2008, our board of directors held six regular meetings and 14 special17 meetings. Our board of directors has the following standing committees: an Audit Committee, a Finance Committee, an HC&CC,a Compensation Committee, an Executive Committee and a Nominating and Corporate Governance Committee. Directors are expected to devote sufficient time to prepare properly for and attend meetings of our board, its committees and executive sessions, and to attend our annual meeting of shareholders. All directors attended at least 75% of the meetings of the board and board committees on which they served during 2007,2008, and eight12 of the ten13 directors who served on our board at the time of our 20072008 annual meeting attended that annual meeting.

Meetings of Outside Directors

In addition to board and committee meetings, our outside directors met 14eight times in 20072008 without management present. Our Lead Independent Director chaired the meetings of our outside directors, and following the appointment of our Chairman on October 8, 2007, he has chaired these meetings.

The Audit Committee

The primary purpose of the Audit Committee is to assist our board in fulfilling its oversight responsibilities with respect to:

the integrity of our financial statements and related disclosures, as well as related accounting and financial reporting processes;

our compliance with legal and regulatory requirements;

our independent registered public accounting firm’s qualifications, independence, audit and review scope, and performance;

the audit scope and performance of our internal audit function; and

our ethics and compliance program.

The Audit Committee also has sole authority for the appointment, retention, termination, compensation, evaluation and oversight of our independent registered public accounting firm. The committee’s principal responsibilities in serving these functions are described in the Audit Committee Charter that was adopted by our board of directors and is annually reviewed and revised as necessary.

Current copies of the Audit Committee Charter and our code of ethics,The Sprint Nextel Code of Conduct, both of which comply with SEC rules and the NYSE corporate governance standards, are available atwww.sprint.com/governance.Copies of the Audit Committee Charter andThe Sprint Nextel Code of Conductmay also be obtained by writing to Sprint Nextel Shareholder Relations, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B424, Overland Park, Kansas 66251, or by email atshareholder.relations@sprint.com.

The Sprint Nextel Code of Conductdescribes the ethical and legal responsibilities of directors and employees of our company and our subsidiaries, including senior financial officers and executive officers. All of our directors and employees (including all senior financial officers and executive officers) are required to comply withThe Sprint Nextel Code of Conduct.In support of the ethics code, we have provided employees with a number of avenues for the reporting of potential ethics violations or similar concerns or to seek guidance on ethics matters, including a 24/7 telephone helpline. The Audit Committee has established procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, including the confidential, anonymous submission by our employees of any concerns regarding questionable accounting or auditing matters to the Ethics Helpline at 1-800-788-7844, by mail to the Audit Committee, c/o Sprint Nextel Corporation, 2001 Edmund Halley Drive, Mailstop VARESPO513-503, Reston, VA 20191,6200 Sprint Parkway, Overland Park, KS 66251, KSOPHF0302-3B424, or by email toboardinquiries@sprint.com. Our Chief Ethics Officer reports regularly to the Audit Committee and annually to the entire board on our Ethics and Compliance program.

The Chair of the Audit Committee is Mr. Hance. The other members are Messrs. Bane, Bennett and Glasscock. Each of the members is financially literate and able to devote sufficient time to serving on the Audit Committee. Our board has determined that each of the Audit Committee members is an independent director under the independence requirements established by our board and the NYSE corporate governance standards. Our board has also determined that Messrs. Bennett, Glasscock and Hance each possess the qualifications of an “audit committee financial expert” as defined in SEC rules. The Audit Committee met seventen times in 2007.2008.

The Finance Committee

The primary functions of the Finance Committee include:

reviewing and approving our financing activities consistent with the authorization levels set forth in our fiscal policy;

reviewing and making recommendations to the board on our capital structure, annual budgets, enterprise risk management program, fiscal policy, investment policy and other significant financial initiatives; and

reviewing and approving proposed acquisitions, dispositions, mergers, joint ventures and similar transactions consistent with the authorization levels set forth in our fiscal policy.

The committee’s principal responsibilities in serving these functions are described in the Finance Committee Charter that was adopted by our board of directors and is annually reviewed and revised as necessary.

The Chair of the Finance Committee is Mr. Bennett. The other members are Messrs. Bane, Glasscock Hance, Swanson and Whitworth.Hance. Each member of the Finance Committee satisfies the independence requirements established by our board and the independence requirements of the NYSE corporate governance standards. The Finance Committee met 1218 times in 2007. 2008.

A current copy of the charter for the Finance Committee is available atwww.sprint.com/governance. It may also be obtained by writing to Sprint Nextel Shareholder Relations, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B424, Overland Park, Kansas 66251, or by email atshareholder.relations@sprint.com.

The Human Capital and Compensation Committee

The primary functions of the HC&CCCompensation Committee include:

developing and overseeing ourdischarging the board’s responsibilities relating to compensation programs and practices for executives generally and for the direct reports of our CEOexecutives in general and the individuals designated as executive officers under Section 16 of the Securities Exchange Act of 1934, which we callour principal senior officers in particular;

evaluating the performance of our CEO and reviewing management’s assessment of the performance of principal senior officers;

setting the annual compensation levels for our CEO and other principal senior officers;

with input from the Nominating and Corporate Governance Committee, making recommendations to the boardreporting on outside director compensation;

making recommendations to the board on incentive compensation plans and equity-based compensation plans that are subject to board approval, including the adoption of those plans and any amendments to those plans;

reviewing and approving executive compensation disclosures made in our annual proxy statement in accordance with applicable rules and annual report on Form 10-K;regulations; and;

determining, approving and acknowledging awards under incentive compensation and equity-based compensation plans, including amendments to the awards under any such plans, and reviewing and monitoring awards under such plans;

reviewing and approving any proposed employment agreement (and any amendments) with principal senior officers;

with input from the Nominating and Corporate Governance Committee, annually reviewing with management plans for the orderly development and succession of senior executive officers; andofficers.

The committee’s principal responsibilities in serving these functions are described in the Compensation Committee Charter that was adopted by our board of directors and is annually reviewing compliance with our executive stock ownership guidelinesreviewed and director stock ownership guidelines.

revised as necessary. Additional information regarding the HC&CC’sCompensation Committee’s processes and procedures can be found below in “Executive Compensation—Compensation Discussion and Analysis.” Generally, the committee’s primary processes for establishing and overseeing outside director compensation and the role of company personnel and compensation consultants are similar to those regarding executive compensation. Any appropriate changes to outside director compensation are made following recommendation to the board by the HC&CC, with input from the Nominating and Corporate GovernanceCompensation Committee. In accordance with its charter, the HC&CCCompensation Committee may delegate authority to subcommittees or any committee member when appropriate.

The Chair of the HC&CCCompensation Committee is Mr. Swanson.Bethune. The other members are Mrs. Hill Ms. Lorimer and Messrs. Bethune, O’NealNuti and Whitworth.O’Neal. Each member of the HC&CCCompensation Committee satisfies the independence requirements established by our board and the independence requirements of the NYSE corporate governance standards. The HC&CCCompensation Committee met ten14 times in 2007.2008.

A current copy of the charter for the HC&CCCompensation Committee is available atwww.sprint.com/governance.It may also be obtained by writing to Sprint Nextel Shareholder Relations, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B424, Overland Park, Kansas 66251, or by email atshareholder.relations@sprint.com. The charter was adopted by our board of directors and is annually reviewed and revised as necessary.

Compensation Committee Interlocks and Insider Participation

Messrs. Bethune, O’Neal and Swanson, Mrs. Hill and Ms. Lorimer served on the HC&CCCompensation Committee during 2007.2008. There were no compensation committee interlocks or insider participation during 2007.2008.

The Executive Committee

The primary function of the Executive Committee is to exercise powers of the board on matters of an urgent nature that arise between regularly scheduled board meetings.

The Chair of the Executive Committee is Mr. Hesse. The other members are Messrs. Bennett, Bethune, Hance Hockaday and Swanson.Hockaday. The Executive Committee did not meet in 2007.2008.

The Nominating and Corporate Governance Committee

The primary function of the Nominating and Corporate Governance Committee is to ensure that our company has effective corporate governance policies and procedures and an effective board and board review process. In fulfilling this function, the committee:

|

assists the board by identifying individuals qualified to become directors;

evaluates and makes recommendationsrecommends to the board onfor approval the director nominees to fill board vacancies between annual meetings of the shareholders as well as nominees (including nominees proposed by shareholders) for election at the next annual meeting of the shareholders;

evaluates and makes recommendationsrecommends to the board on a director’s retirement, an offer to resign due to a change in circumstances, or a resignation tendered as a resultfor approval the chairs and members of a director’s failure to receive the required number of votes for re-election;

evaluateseach board committee; and makes recommendations to the board on the appointment of directors to board committees and the selection of board committee chairs;

develops, reviews and makes recommendationsrecommends to the board on corporate governance policies and practices designed to benefit our shareholders;shareholders.

provides input toThe committee’s principal responsibilities in serving its primary function are described in the HC&CC on outside director compensationNominating and the orderly developmentCorporate Governance Committee Charter that was adopted by our board of directors and succession of senior executive officers;is annually reviewed and revised as necessary.

oversees the annual board, board committee and director self evaluation process.

In evaluating prospective candidates or current board members for nomination, the Nominating and Corporate Governance Committee considers all factors it deems relevant, including, but not limited to, the candidate’s: (1) character, including reputation for personal integrity and adherence to high ethical standards,standards; (2) judgment,judgment; (3) knowledge and experience in leading a successful company, business unit or other institution,institution; (4) independence from our company,company; (5) ability to contribute diverse views and perspectives,perspectives; (6) business acumenacumen; and (7) ability and willingness to devote the time and attention necessary to be an effective director — all in the context of an assessment of the needs of the board at that point in time.

The Nominating and Corporate Governance Committee reviews with the board the appropriate characteristics and background needed for directors. This review is undertaken not only in considering new candidates for board membership, but also in determining whether to nominate existing directors for another term. The Nominating and Corporate Governance Committeecommittee determines the current director selection criteria and conducts searches for prospective directors whose skills and attributes reflect these criteria. To assist in the recruitment of new members to our board, the Nominating and Corporate Governance Committeecommittee employs one or more third-party search firms. All approvals of nominations are determined by the full board.

It is the policy of the Nominating and Corporate Governance Committee also to consider candidates recommended by shareholders. These recommendations should be sent to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Sprint Nextel Corporation, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B424, Overland Park, Kansas 66251. To be timely, your recommendation must be received by our Corporate Secretary between December 15, 200813, 2009 and January 13, 2009.12, 2010. Your recommendation must include the following for each candidate you intend to recommend:

name, age, business address and residence address;

principal occupation or employment;

the class and number of shares of our stock beneficially owned;

a description of all arrangements or understandings relating to the nomination between or among you, each nominee, and any other person or persons;

the signed consent of each nominee to serve as a director if so elected;

any other information that is required by law to be disclosed in connection with solicitations of proxies for the election of directors; and

| • | a statement signed by the nominee that indicates whether the nominee, if elected as a director, intends to comply with ourCorporate Governance Guidelines. |

The notice must also include your name and address and the class and number of shares of our stock that you own.

Majority Voting

On February 27, 2007, our board approved amendments to ourOur bylaws to provide that each nominee for director in an uncontested election will be elected if the votes cast for that nominee exceed the votes cast against that nominee. Votes cast do not include abstentions and broker

non-votes. The date for determining if an election is contested or uncontested has been set at 14 days before we file our definitive proxy statement. This requirement is intended to help us determine for our proxy statement whether director nominees will be elected under a majority or plurality standard prior to soliciting proxies.

In connection with the amendments to our bylaws establishing a majority vote standard for the election of directors in uncontested elections, our board also amended ourOurCorporate Governance Guidelinesto provide that an incumbent nominee who fails to receive a majority ofreceives fewer votes cast“for” than “against” in an uncontested election is expected to tender promptly his or her resignation. The Nominating and Corporate Governance Committeecommittee will recommend, and the board will determine, whether or not to accept the tendered resignation within 90 days of the certification of the shareholder vote with respect to the director election. Our board’s decision will be publicly disclosed.

In connection with the board’s three-year independent director evaluation in February 2006, the board agreed to permit the rights issuable pursuant to our rights plan to expire in June 2007 in accordance with the plan. We currently do not have a shareholder rights plan in place.

The Chair of the Nominating and Corporate Governance Committee is Mr. Hockaday. The other members are Mrs. Hill Ms. Lorimer and Messrs. Bethune, Ianna, Nilsson and O’Neal. Each member of the Nominating and Corporate Governance Committee satisfies the independence requirements established by our board and the independence requirements of the NYSE corporate governance standards. The Nominating and Corporate Governance Committee met sixeight times in 2007.2008.